Nebraska

FY 2024

On May 20, 1785, the Continental Congress provided land to support schools as each new state joined the union. “There shall be reserved the lot No.16, of every township, for the maintenance of public schools within the said township.” Over 134 million acres were subsequently granted in trust as a condition of statehood. Today over 45 million acres continue to be held in trust by 20 states for the support of public schools. Revenue is placed in permanent school funds, now over $115 billion, and over $5 billion was distributed to western schools in FY 2024. However, few educators or members of the public know about school trust lands. Advocates for School Trust Lands is sharing this grand history of America’s founding vision for schools, hoping that over time Americans will know of school trust lands and their support for public schools.

At statehood on March 1, 1867, schools were granted almost three million acres by Congress to support Nebraska public schools. [1] The school trust lands are part of a “sacred compact” between Nebraska and the United States. The enabling act requires the state to act with undivided loyalty as it manages the school lands in trust to support public schools.

Nebraska has 1,250,911 school surface acres remaining and 1.6 million school subsurface acres scattered around the state. These lands are managed by the Board of Educational Lands and Funds, comprised of five Board Members. The office is managed by Kelly Sudbeck, an attorney well versed in trust law whose purpose is to act with undivided loyalty to the school beneficiary. Their most significant accomplishments this fiscal year have been to maximize agricultural and renewable energy income.

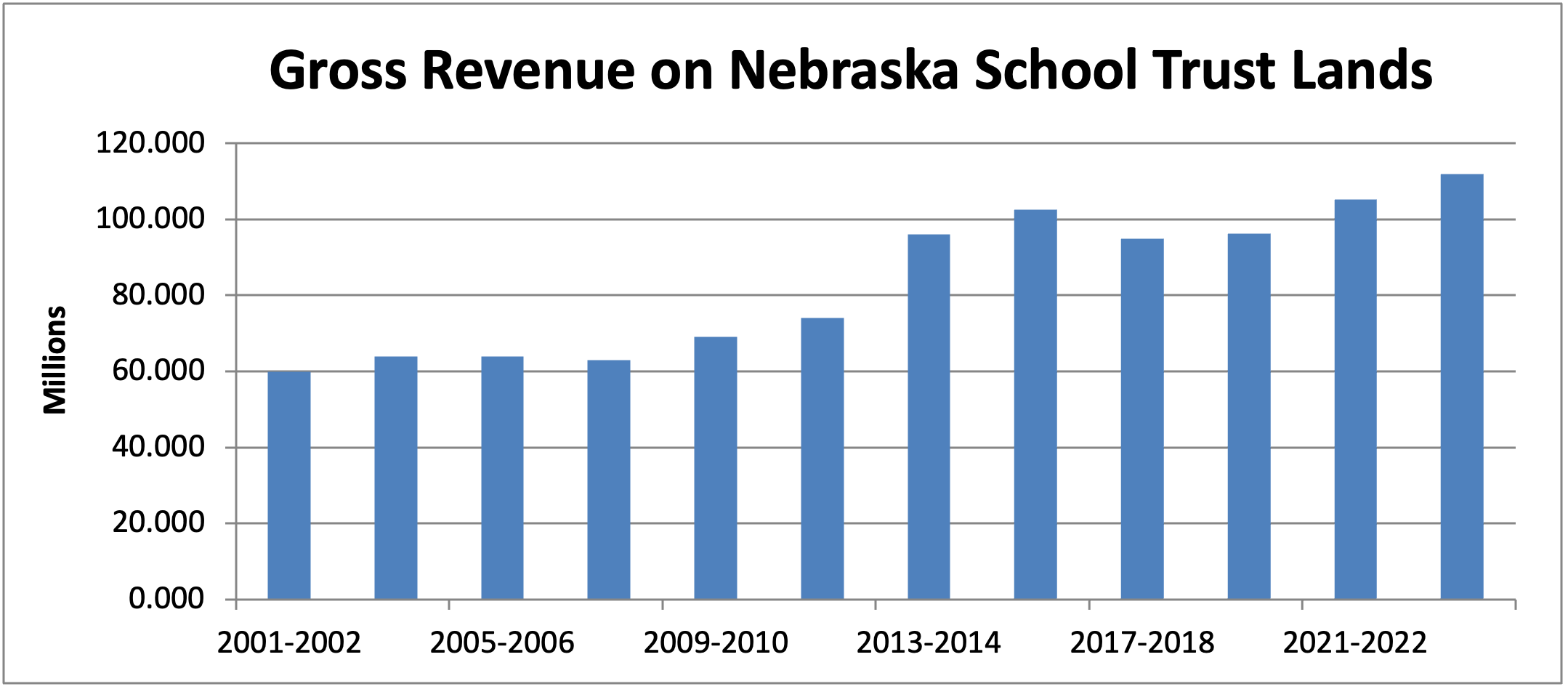

The largest revenue source is agricultural rentals and bonuses. Mineral revenue is primarily from oil and gas but wind and solar are an increasing portion of the trust portfolio. In the last twenty five years, the land office has managed to double the revenue.

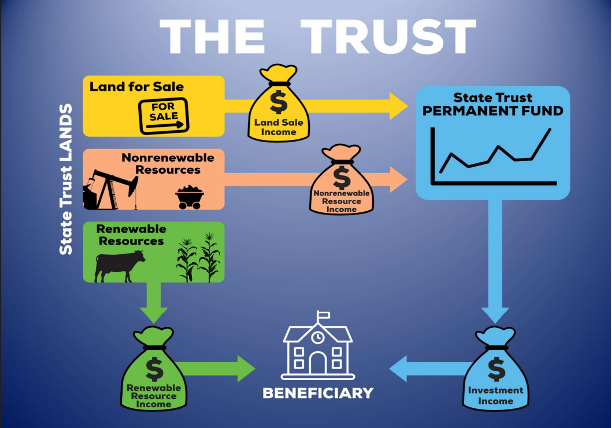

The chart below clearly shows that land sale and nonrenewable revenue—both of which are a revenue that can only occur once—are all saved and invested to provide a continuing revenue to future generations of schools. Revenue from activities that can be repeated on a given parcel such as ranching or agriculture are distributed to schools on an annual basis. Investments in the ever growing Permanent School Fund are then distributed annually to schools. The chart below clearly shows the flow of funds from the lands and to the K-12 schools.

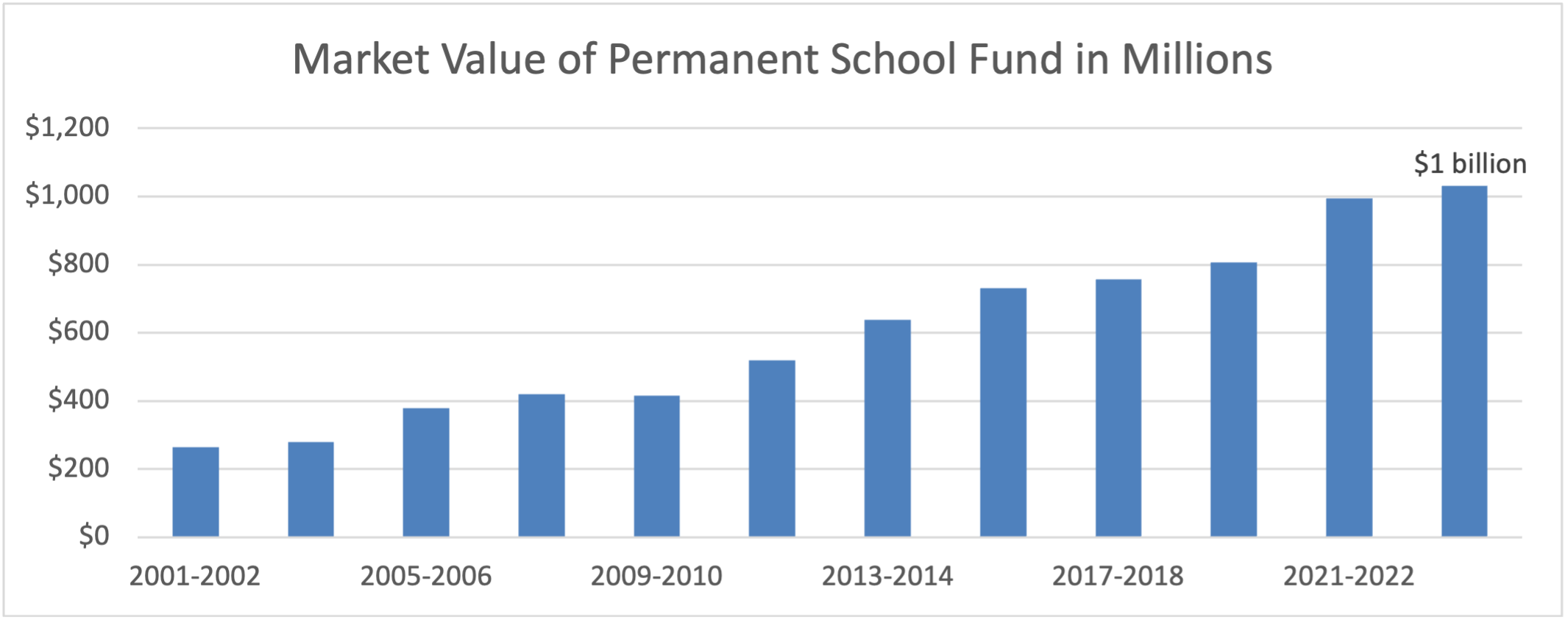

The Permanent School Fund is invested by the Nebraska Investment Council. Some states have chosen to deposit all revenues from school lands into their respective permanent fund. By contrast, Nebraska and other states allocate only specific types of revenue directly to the Permanent School Fund, so their fund grows more slowly but they have more to distribute now. Mineral royalties and land sale payments are deposited into the Fund whereas rent and bonuses from agricultural land, a majority of the revenue, are distributed to schools. From 2002 through 2012, in Nebraska, the land has performed significantly better than the permanent fund, having a return on investment of 12% compared to 6% on the invested portion.

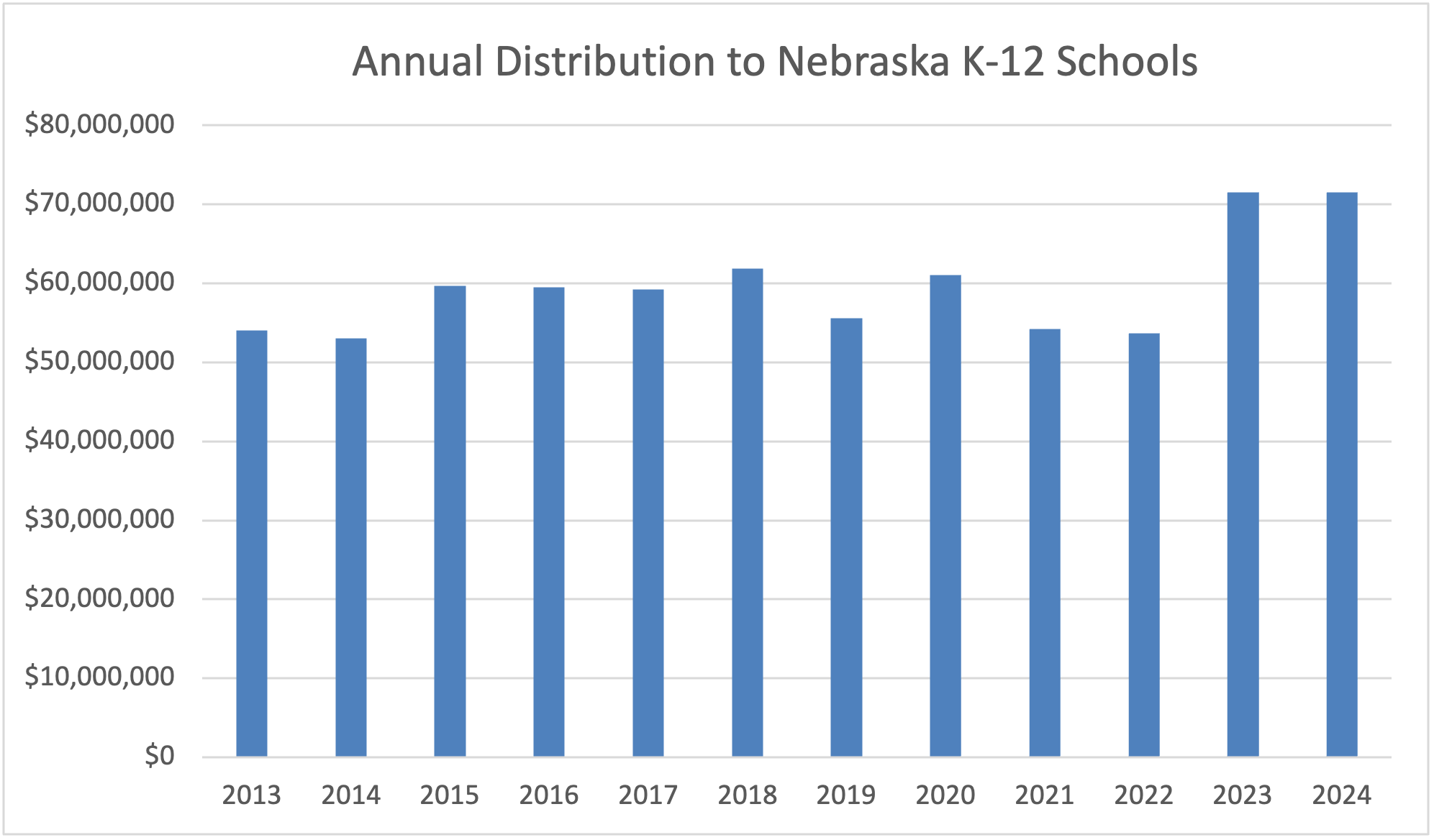

In Nebraska the revenue from the school trust lands is sent directly to the county school districts. The actual Enabling Act designates the “common schools” as the beneficiary. It is unclear from reading the annual report of the Board of educational Lands and Funds whether there is a mechanism to ensure the revenue goes to the “common schools” as required in the trust documents. Below is a chart depicting how much is distributed annually from the school trust.

The revenue from school lands and funds in other states:

• Wisconsin funds school libraries,

• Washington builds school buildings,

• Arizona funds classroom needs,

• Nebraska, Minnesota and South Dakota send funds directly to each district for school needs,

• Colorado spends all the revenue each year for school buildings and improvements in the B.E.S.T. program which spends all the non-renewable revenue that belongs to future generations and should be deposited in the permanent school fund for current and future generations of school students,

• Utah sends the funds directly to each school for educational programs developed by parents, teachers and the principal to improve student academic performance, and

• most remaining states, send the trust distribution to the State Office of Education with no assurance mechanism that every dollar is distributed to schools. This is a violation of their enabling act because the grant of lands was for the “support of schools” not education broadly.

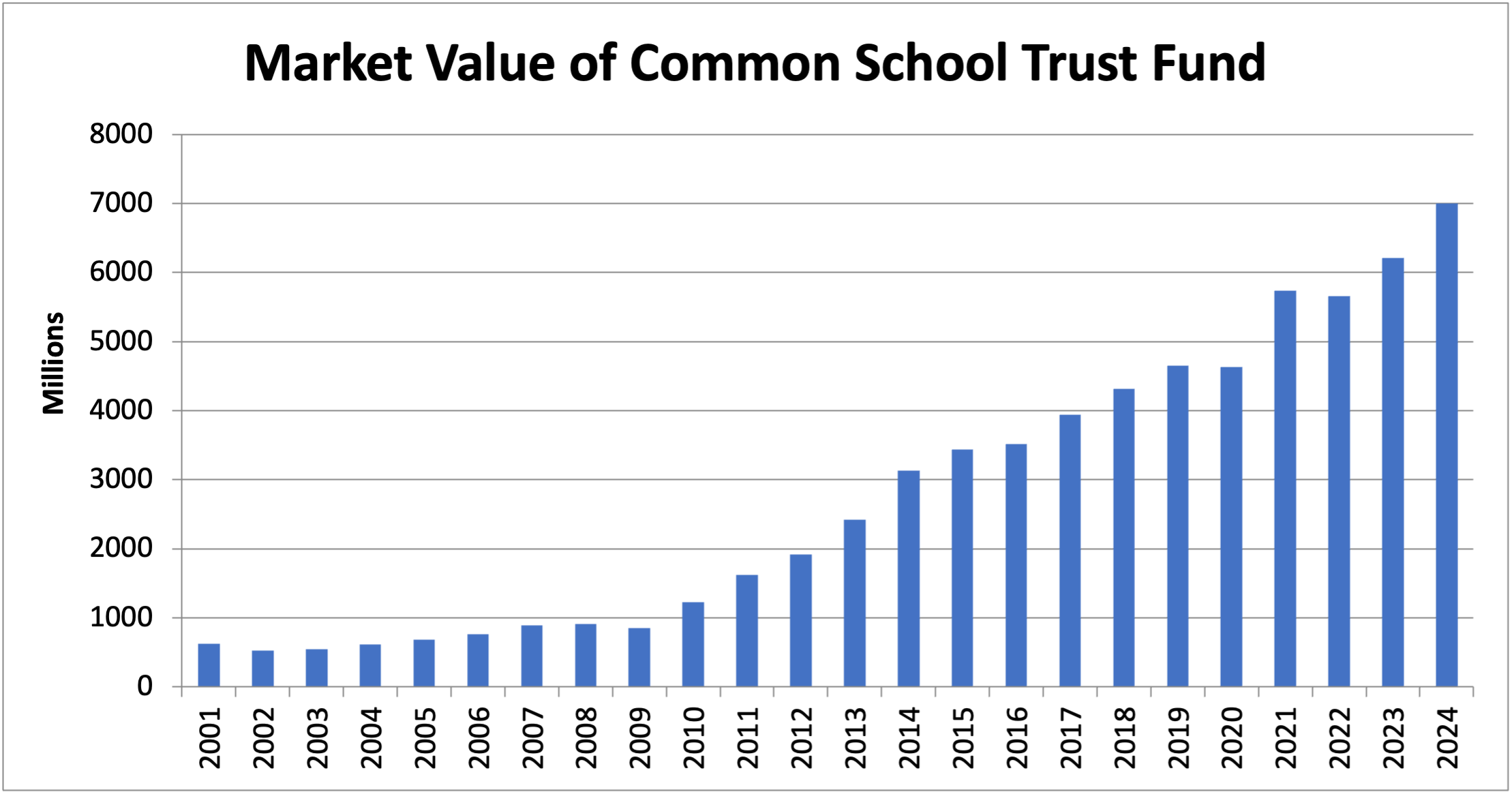

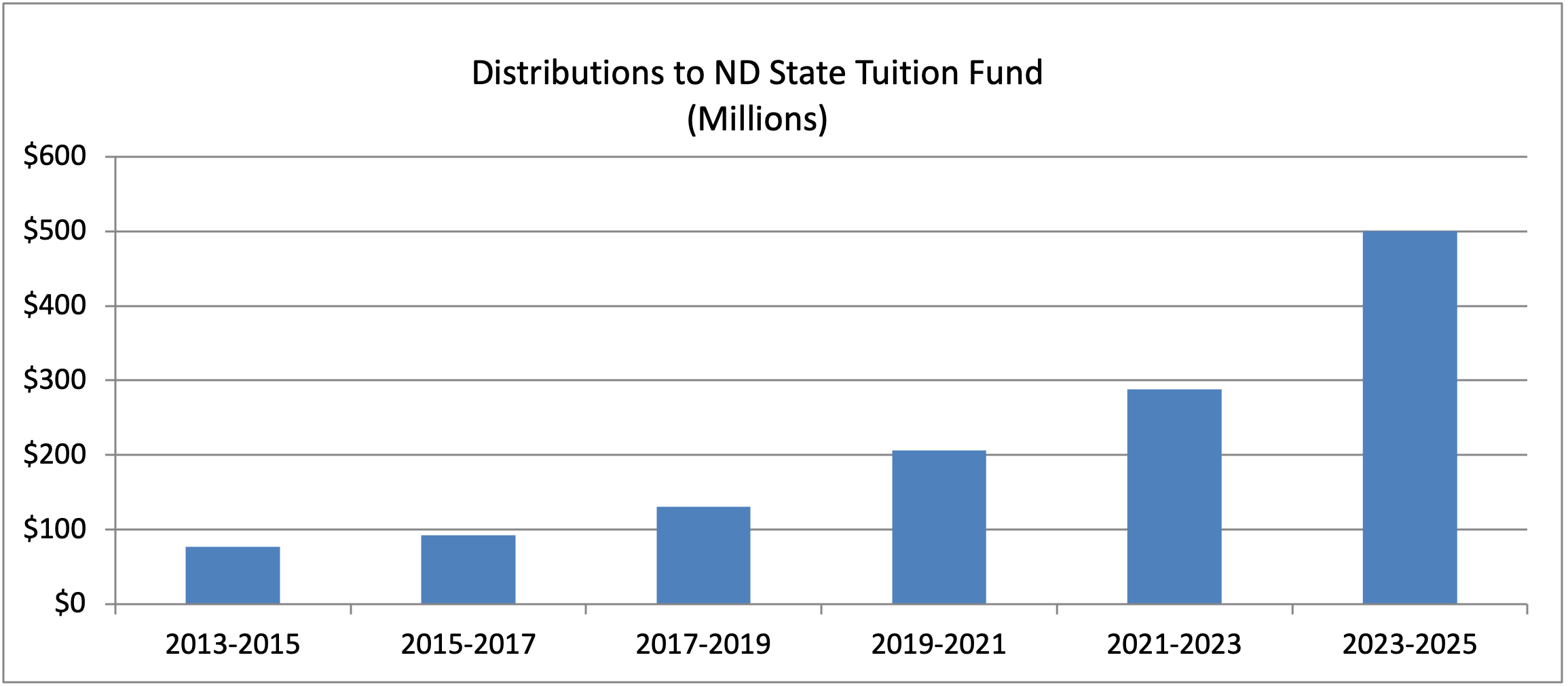

North Dakota deposits all revenue from the school trust lands into the Common Schools Trust Fund. In addition, North Dakota also deposited additional millions from the Tobacco Lawsuit Settlement, unclaimed property turned into the state, and the oil extraction tax. From these deposits is deducted the trust expenses. Net income is prudently invested, and schools receive annual distributions based on a five year average value of the Common Schools Trust Fund. States like North Dakota that invest all of their revenue in the Common School Trust Fund plus additional funds have, over time, more money to support schools, just as people who save have more money than those who spend all they make. When prudently invested, the Common Schools Trust Fund will generate greater revenue to schools.

The North Dakota Common School Trust Fund has had phenomenal growth over the last 39 years, growing from a market value of just under $240 million to now being within a hair’s breath of being $7 billion—a growth of 2900%. As of June 30, 2025, the market value of the fund stands at $6,997,804,865. The fund is prudently invested and generating a total weighted 5-year return on investment of 5.68%.

The Common School Trust Fund is constitutionally established and recognized as a trust by the United States Supreme Court. It is intended to be a forever charitable trust. The obligations to protect and grow this forever trust were accepted by the state as a condition of statehood. The state of North Dakota committed to acting with undivided loyalty to both the lands and resulting funds for the sole benefit of schools. The state’s commitment to the School Trust has reaped significant benefits to schools. It is anticipated that by next biennium, the Common School Trust Fund will distribute 25% of the state’s share of education.

That investment return resulted in the Common School Trust Fund in biennium 2023-2025 distributing $500 million to North Dakota schools. That distribution is equivalent to $2,160 per student. Only Wyoming distributes more per student and that is primarily because Wyoming has far fewer students in the public schools.

[1] 2,730,951 acres