California

FY 2024

On May 20, 1785, the Continental Congress provided land to support schools as each new state joined the union. “There shall be reserved the lot No.16, of every township, for the maintenance of public schools within the said township.” Over 134 million acres were subsequently granted in trust as a condition of statehood. Today over 45 million acres continue to be held in trust by states for the support of public schools. Revenue is placed in permanent school funds, now over $115 billion, and $5 billion was distributed to western schools in FY 2024. However, few educators or members of the public know about school trust lands. Advocates for School Trust Lands is sharing this grand history of America’s founding vision for schools, hoping that over time Americans will know of school trust lands and their support for public schools.

Five and a half million acres of school lands were granted at statehood in 1850 by Congress to California to support California public schools. That was 6% of all the land in the new state of California. From that original grant, there remains today 458,843 acres of surface lands and about 790,000 acres of mineral rights. The school trust lands are part of a “sacred compact” or enabling act between the state and Congress requiring the state to act with undivided loyalty as it manages the school lands in trust to support public schools.

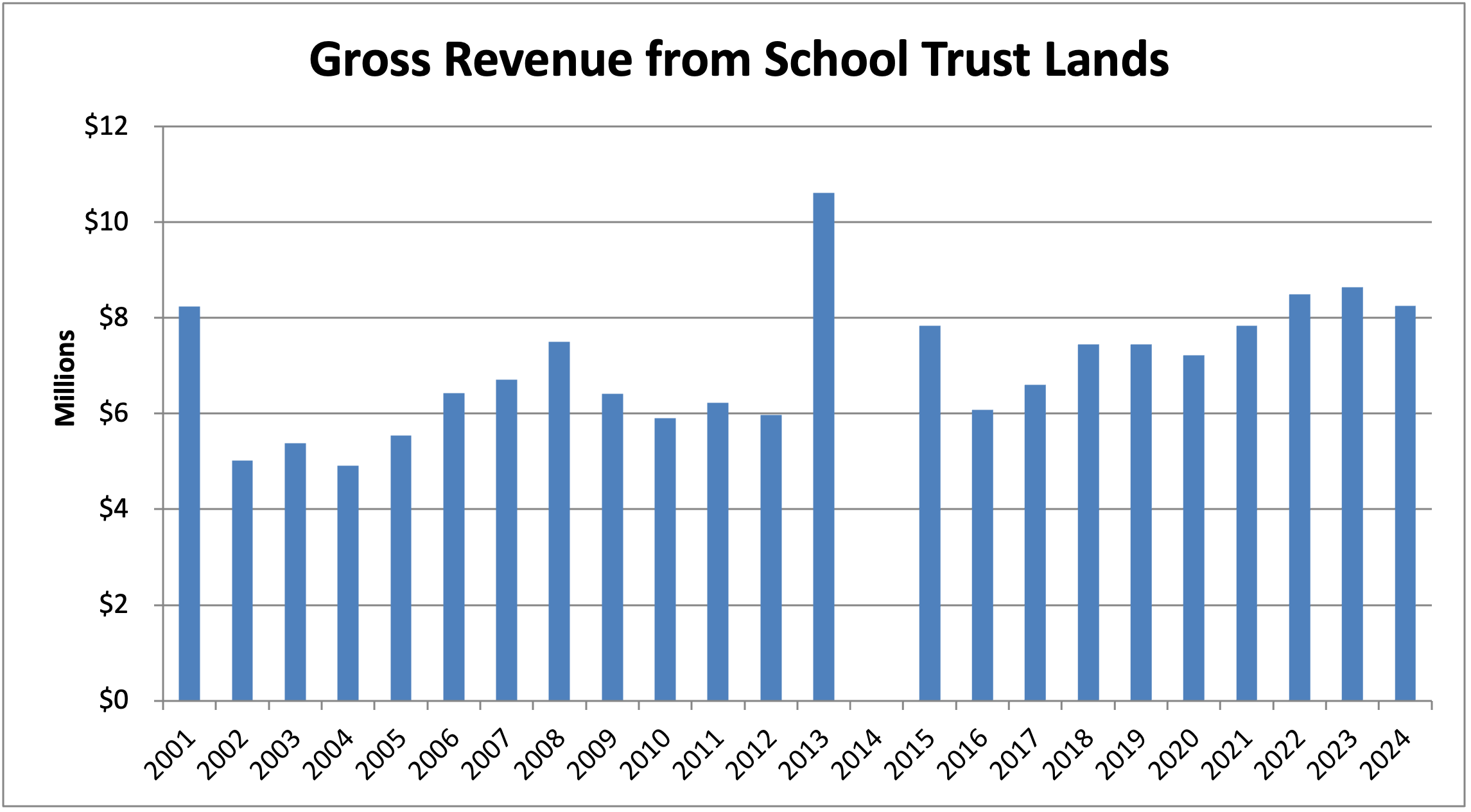

Annual revenue from these lands in FY 2024 was $8,256,633. By far the largest revenue source is geothermal steam with additional contributions from oil, gas, and other minerals. A much smaller contribution came from surface leases for wind, solar, and forestry on the school trust lands.

The lands are managed by two divisions of the California State Lands Commission. The Mineral Resources Management Division leases geothermal, mining, oil and gas lands, including collecting rental and production royalty payments. The Land Management Division oversees all surface land transactions including sales, exchanges and acquisitions, as well as agriculture, grazing, pipe and transmission lines, rights of way and surface leases. All expenses of the Land Commission and office are paid from the revenue that is generated. All net sale revenue is deposited in the State Treasury to the credit of the School Land Bank Fund. All other net revenue is regrettably deposited into the State Treasury to the credit of the State Teachers’ Retirement Fund. The revenue from the School Land Bank Fund benefits only retired teachers with no benefit to the public schools who are the named beneficiary of the lands in the California Enabling Act. To most readers of this report familiar with trust principles, the California legislature is in a position of breach of trust because the California state constitution and the state statutes do not comply with the provisions in the Enabling Act in which the lands were granted in trust for schools. To be a state, California voters passed the first state constitution accepting these 5.5 million acres held solely for the benefit of common schools.

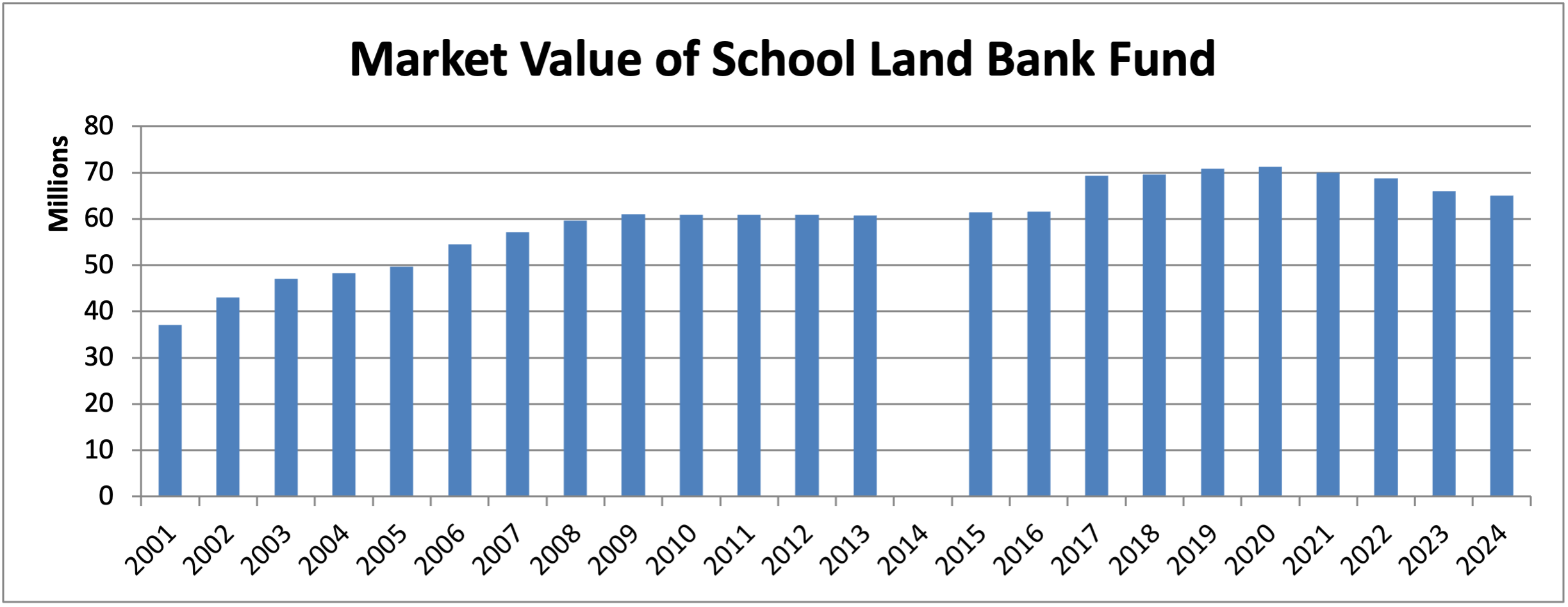

Net revenue from activities on the school trust lands is deposited in the School Land Bank Fund. [1] The market value of the fund is $64,965,889 as of June 30, 2024. The state borrowed $59 million of the $61 million invested in the School Land Bank Fund. The loan was repaid by June 30, 2016 with interest based on the rate generated by the Pooled Money Investment Account. Most of the states east of the Mississippi River lost their school endowment funds when borrowed funds were never repaid. California is applauded for its commitment to their school trust by repaying the loan. The fund appears to be returning very small amounts from their investments while investments in equities by other states have provided double digit returns to school funds.

The revenue from school lands and funds are used by schools differently in various states. Wisconsin funds school libraries, Washington and Colorado build schools in rural parts of the state, Arizona funds classroom needs, and Utah empowers school councils to implement academic programs in each school. Unfortunately, California school lands do not benefit California schools at all. The revenue benefits the State Teachers’ Retirement System—not schools at all.

[1] Loan was part of Budget Act of 2008, as amended by Chapter 2, Statutes of 2009 Third Extraordinary Session.